Difference between revisions of "Manuals/calci/SLN"

Jump to navigation

Jump to search

(Created page with "<div id="6SpaceContent" class="zcontent" align="left"> <font color="#000000"><font face="Arial, sans-serif"><font size="2">'''SLN'''</font></font><font face="Arial, sans-...") |

|||

| Line 1: | Line 1: | ||

| − | + | =SLN(C, Salvage, L)= | |

| − | < | + | Where |

| + | *<math>C</math> is the initial cost of an asset, | ||

| + | *<math>Salvage</math> is the value at the end of depreciation, and | ||

| + | *<math>L</math> is the life of an asset that indicates the number of periods over which the asset is being depreciated. | ||

| − | + | SLN() calculates the straight-line depreciation of an asset for one period. | |

| − | + | == Description == | |

| − | |||

| − | |||

| − | |||

| − | |||

| − | + | SLN(C, Salvage, L) | |

| − | < | + | *Depreciation is the decrease in value of an asset. |

| − | -- | + | *If <math>L</math> is <=0, Calci displays #N/A error message. |

| − | + | *If 'C' is the cost of fixed asset, 'Salvage' is the residual value and 'L' is the life of an asset, then Depreciation using Straight-line method is calculated as - | |

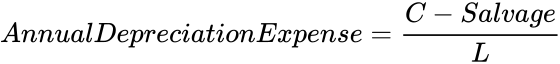

| − | < | + | <math>Annual Depreciation Expense = \frac{C - Salvage}{L}</math> |

| − | + | == Examples == | |

| − | + | Consider the following example that shows the use of SLN function: | |

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

<div id="2SpaceContent" class="zcontent" align="left"> | <div id="2SpaceContent" class="zcontent" align="left"> | ||

{| id="TABLE3" class="SpreadSheet blue" | {| id="TABLE3" class="SpreadSheet blue" | ||

|- class="even" | |- class="even" | ||

| + | | class=" " | 45,000 | ||

| + | | class=" " | | ||

| class=" " | | | class=" " | | ||

| − | + | ||

| − | |||

| − | |||

| − | |||

|- class="odd" | |- class="odd" | ||

| − | | class=" " | | + | | class=" " | 11,000 |

| − | + | | class=" " | | |

| − | |||

| − | | class=" " | | ||

| class=" " | | | class=" " | | ||

| + | |||

|- class="even" | |- class="even" | ||

| − | | class=" | + | | class=" " | 12 |

| − | + | | class=" " | | |

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | | class=" " | | ||

| class=" " | | | class=" " | | ||

| + | |||

|- class="odd" | |- class="odd" | ||

| − | + | | class=" " | | |

| − | + | | class=" " | | |

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | | class=" " | | ||

| − | | class=" " | | ||

| class=" " | | | class=" " | | ||

|} | |} | ||

| − | < | + | =SLN(A1,A2,A3) : Calculates the depreciation for values in the range A1 to A3. <br />Displays '''2833.3333333333335''' as a result. |

| − | + | =SLN(20000,1000,10.5) : Displays '''1809.5238095238096''' as a result. | |

| + | |||

| + | == See Also == | ||

| + | |||

| + | *[[Manuals/calci/db | db]] | ||

| + | *[[Manuals/calci/DDB | DDB]] | ||

| + | |||

| + | == References == | ||

| + | |||

| + | *[http://en.wikipedia.org/wiki/Depreciation Depreciation] | ||

| + | *[http://en.wikipedia.org/wiki/Depreciation#Straight-line_depreciation Straight Line Depreciation] | ||

Revision as of 17:39, 27 February 2014

SLN(C, Salvage, L)

Where

- is the initial cost of an asset,

- is the value at the end of depreciation, and

- is the life of an asset that indicates the number of periods over which the asset is being depreciated.

SLN() calculates the straight-line depreciation of an asset for one period.

Description

SLN(C, Salvage, L)

- Depreciation is the decrease in value of an asset.

- If is <=0, Calci displays #N/A error message.

- If 'C' is the cost of fixed asset, 'Salvage' is the residual value and 'L' is the life of an asset, then Depreciation using Straight-line method is calculated as -

Examples

Consider the following example that shows the use of SLN function:

| 45,000 | ||

| 11,000 | ||

| 12 | ||

=SLN(A1,A2,A3) : Calculates the depreciation for values in the range A1 to A3.

Displays 2833.3333333333335 as a result. =SLN(20000,1000,10.5) : Displays 1809.5238095238096 as a result.

is the initial cost of an asset,

is the initial cost of an asset, is the value at the end of depreciation, and

is the value at the end of depreciation, and is the life of an asset that indicates the number of periods over which the asset is being depreciated.

is the life of an asset that indicates the number of periods over which the asset is being depreciated.