Difference between revisions of "Manuals/calci/NOMINAL"

Jump to navigation

Jump to search

| Line 54: | Line 54: | ||

=NOMINAL(A1,A2) ''displays 0.05622136652263632'' as a result. | =NOMINAL(A1,A2) ''displays 0.05622136652263632'' as a result. | ||

=NOMINAL("6.10%",6) ''displays 0.05950499347618399'' as a result. | =NOMINAL("6.10%",6) ''displays 0.05950499347618399'' as a result. | ||

| + | |||

| + | ==Related Videos== | ||

| + | |||

| + | {{#ev:youtube|-3VDp4mmr2s|280|center|NOMINAL Function}} | ||

== See Also == | == See Also == | ||

Revision as of 13:13, 19 July 2015

NOMINAL(ER, nperyear)

Where

- is the effective interest rate, and

- is the number of compounding periods per year.

NOMINAL() calculates the nominal annual interest rate.

Description

NOMINAL(ER, nperyear)

- Nominal Interest Rate is calculated depending on the effective interest rate and the number of compounding periods per year.

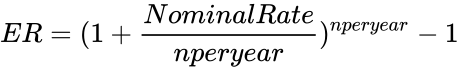

- The relationship between Effective Interest Rate and Nominal Interest Rate is as follows -

where

- Effective Interest Rate

- Nominal Interest Rate

- number of compounding periods per year

- Arguments and should be numeric, else Calci returns #N/A error message.

- If < 0 or if < 1, Calci returns #N/A error message.

- If is not an integer, it is truncated.

Examples

Consider the following example that shows the use of NOMINAL function:

| 5.75% | ||

| 5 | ||

=NOMINAL(A1,A2) displays 0.05622136652263632 as a result.

=NOMINAL("6.10%",6) displays 0.05950499347618399 as a result.

is the effective interest rate, and

is the effective interest rate, and is the number of compounding periods per year.

is the number of compounding periods per year.

- Nominal Interest Rate

- Nominal Interest Rate