Difference between revisions of "Manuals/calci/accrintm"

Jump to navigation

Jump to search

| Line 32: | Line 32: | ||

| 1 | | 1 | ||

| 3/1/2008 | | 3/1/2008 | ||

| + | | | ||

|- class="even" | |- class="even" | ||

| 2 | | 2 | ||

| 8/15/2008 | | 8/15/2008 | ||

| + | | | ||

|- class="odd" | |- class="odd" | ||

| 3 | | 3 | ||

| 12% | | 12% | ||

| + | | | ||

|- class="even" | |- class="even" | ||

| 4 | | 4 | ||

| 1000 | | 1000 | ||

| + | | | ||

|- class="odd" | |- class="odd" | ||

| 5 | | 5 | ||

| 3 | | 3 | ||

| + | | | ||

|} | |} | ||

{| class="wikitable" | {| class="wikitable" | ||

| Line 51: | Line 56: | ||

|- | |- | ||

! 1 | ! 1 | ||

| − | | 3/1/2008 | + | | 3/1/2008 |

| + | | | ||

|- | |- | ||

! 2 | ! 2 | ||

| 8/15/2008 | | 8/15/2008 | ||

| + | | | ||

|- | |- | ||

! 3 | ! 3 | ||

| 12 | | 12 | ||

| + | | | ||

|- | |- | ||

! 4 | ! 4 | ||

| 1000 | | 1000 | ||

| + | | | ||

|- | |- | ||

! 5 | ! 5 | ||

| 3 | | 3 | ||

| + | | | ||

|} | |} | ||

Revision as of 23:53, 26 February 2014

ACCCRINTM(I, Settle,R,Par,basis)

- Security's issue date.

- Security's settlement date should be after issue date.

- Security annual coupon rate.

- Security par value.

- Type of day count basis.

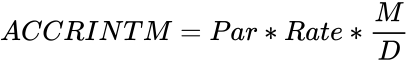

Description

- This function returns the accumulated interest for a security that pays interest at maturity.

- Issue, Basis, Settlement be integers.

- ACCRINTM shows the error value when:

1.R less-than or equal to 0 2.Par less-than or equal to 0 3.basis < 0 or basis > 4 4.I date greater-than or equal to settle date.

- number of days counted from issue date to maturity date.

- Annual Year Basis.

Example

=ACCRINTM("3/1/2008","8/15/2008",12,1000,3) 5490.41095890411 =

| A | ||

| 1 | 3/1/2008 | |

| 2 | 8/15/2008 | |

| 3 | 12% | |

| 4 | 1000 | |

| 5 | 3 |

| A | B | |

|---|---|---|

| 1 | 3/1/2008 | |

| 2 | 8/15/2008 | |

| 3 | 12 | |

| 4 | 1000 | |

| 5 | 3 |

=ACCRINTM("3/1/2008","8/15/2008",12,1000,3)

5490.41095890411

=

Security's issue date.

Security's issue date. Security's settlement date should be after issue date.

Security's settlement date should be after issue date. Security annual coupon rate.

Security annual coupon rate. Security par value.

Security par value. Type of day count basis.

Type of day count basis.

number of days counted from issue date to maturity date.

number of days counted from issue date to maturity date. Annual Year Basis.

Annual Year Basis.