Difference between revisions of "Manuals/calci/TBILLPRICE"

Jump to navigation

Jump to search

| Line 18: | Line 18: | ||

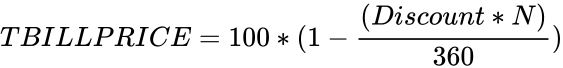

If 'N' is number of days from 'Settlement' to 'Maturity', then TBILLPRICE is calculated as - | If 'N' is number of days from 'Settlement' to 'Maturity', then TBILLPRICE is calculated as - | ||

| − | <math>TBILLPRICE = 100 * (1 - \frac{(Discount * N | + | <math>TBILLPRICE = 100 * (1 - \frac{(Discount * N)}{360}) </math> |

== Examples == | == Examples == | ||

Revision as of 16:04, 28 February 2014

TBILLEQ(SettlementDate, MaturityDate, Discount)

where,

- is the Treasury Bill's settlement date (a date when the Treasury Bill is purchased)

- is the Treasury Bill's maturity date (a date when the Treasury Bill expires)

- is the Treasury Bill's discount rate.

TBILLEQ() calculates the price per $100 face value for a Treasury Bill.

Description

TBILLEQ(SettlementDate, MaturityDate, Discount)

- and should be entered either in 'date format' or 'dates returned using formulas'. If dates are not valid, Calci displays #N/A error message.

- If >= , Calci displays #N/A error message.

- should not be greater than one year from . Else, Calci displays #N/A error message.

- If <=0, Calci displays #N/A error message.

- Formula:

If 'N' is number of days from 'Settlement' to 'Maturity', then TBILLPRICE is calculated as -

Examples

Consider the following example that shows the use of TBILLPRICE function:

| 01/01/2010 | ||

| 11/20/2010 | ||

| 5.85% | ||

=TBILLPRICE(A1,A2,A3) : Calculates the price for the Treasury Bill with values in the range A1 to A3.

Displays 94.75125 as a result. =TBILLPRICE(DATE(2013,10,20),DATE(2014,6,20),9%) : Calculates the price for the Treasury Bill with

the mentioned values. Displays 93.925 as a result.

is the Treasury Bill's settlement date (a date when the Treasury Bill is purchased)

is the Treasury Bill's settlement date (a date when the Treasury Bill is purchased) is the Treasury Bill's maturity date (a date when the Treasury Bill expires)

is the Treasury Bill's maturity date (a date when the Treasury Bill expires) is the Treasury Bill's discount rate.

is the Treasury Bill's discount rate.