Difference between revisions of "Manuals/calci/NPV"

Jump to navigation

Jump to search

(Created page with "<div id="6SpaceContent" class="zcontent" align="left"> <font color="#000000"><font face="Arial, sans-serif"><font size="2">'''NPVDR'''</font></font><font face="Arial, san...") |

|||

| (6 intermediate revisions by 3 users not shown) | |||

| Line 1: | Line 1: | ||

| − | <div | + | <div style="font-size:30px">'''NPV()'''</div><br/> |

| + | *First parameter is the discount rate for the period. | ||

| + | *From the second parameter indicates the payments and income. | ||

| + | **NPV(), returns the net present value of an investment based on a series of periodic cash flows and a discount rate. | ||

| − | < | + | ==Description== |

| + | *This function gives the net present value of an investment. | ||

| + | *Net present value is the difference between the present value of cash inflows and the present value of cash outflows. | ||

| + | *The <math>NPV</math> analysis is sensitive to the reliability of future cash inflows that an investment or project will yield. | ||

| + | *In <math>NPV()</math>, first parameter is the discount rate for one period. | ||

| + | *From the second parameter are representing the payments and income. | ||

| + | *Payments are equally spaced in time and occur at the end of the period. | ||

| + | *Arguments can be numbers ,empty cells,logical values or text representations of numbers. | ||

| + | *But error values or text that cannot be translated in to numbers. | ||

| + | *<math>NPV</math> is related with the functions <math>PV</math> and <math>IRR</math>. | ||

| + | *The cash flows to begin either at the end or at the beginning of the period is the main difference between <math>NPV</math> and <math>PV</math>. | ||

| + | *Also <math>IRR</math> is the rate for which <math>NPV</math> equals zero.<math>NPV(IRR(....),...)=0</math>. | ||

| + | *The formula for <math>NPV</math> is: | ||

| + | <math>NPV=\sum_{i=1}^n \frac{values_i}{(1+rate)^i}</math>,where <math>n</math> is the number of cash flows in the list of values. | ||

| − | |||

| − | + | ==Examples== | |

| + | #=NPV(9%,-55000,2000,3500,6200,8500,10000) = -30193.387068 | ||

| + | #=NPV(6%,-2000,294,489,780,520,1250) = 673.05 | ||

| + | #=NPV(12%,-25000,3000,7500,4200,5100,12700,10000) = 1929.2652056111 | ||

| − | + | ==Related Videos== | |

| − | |||

| − | |||

| − | + | {{#ev:youtube|v=yelsD-wyILI|280|center|NPV Function}} | |

| − | + | ==See Also== | |

| − | + | *[[Manuals/calci/FV | FV ]] | |

| − | + | *[[Manuals/calci/IRR | IRR ]] | |

| + | *[[Manuals/calci/PV | PV ]] | ||

| − | + | ==References== | |

| − | * | + | *[http://en.wikipedia.org/wiki/Net_present_value Net Present Value] |

| − | |||

| − | |||

| − | |||

| − | + | *[[Z_API_Functions | List of Main Z Functions]] | |

| − | + | *[[ Z3 | Z3 home ]] | |

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

Latest revision as of 16:02, 15 November 2018

NPV()

- First parameter is the discount rate for the period.

- From the second parameter indicates the payments and income.

- NPV(), returns the net present value of an investment based on a series of periodic cash flows and a discount rate.

Description

- This function gives the net present value of an investment.

- Net present value is the difference between the present value of cash inflows and the present value of cash outflows.

- The analysis is sensitive to the reliability of future cash inflows that an investment or project will yield.

- In , first parameter is the discount rate for one period.

- From the second parameter are representing the payments and income.

- Payments are equally spaced in time and occur at the end of the period.

- Arguments can be numbers ,empty cells,logical values or text representations of numbers.

- But error values or text that cannot be translated in to numbers.

- is related with the functions and .

- The cash flows to begin either at the end or at the beginning of the period is the main difference between and .

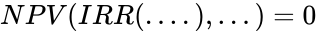

- Also is the rate for which equals zero..

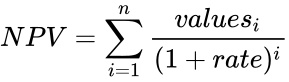

- The formula for is:

,where is the number of cash flows in the list of values.

Examples

- =NPV(9%,-55000,2000,3500,6200,8500,10000) = -30193.387068

- =NPV(6%,-2000,294,489,780,520,1250) = 673.05

- =NPV(12%,-25000,3000,7500,4200,5100,12700,10000) = 1929.2652056111

Related Videos

See Also

References

analysis is sensitive to the reliability of future cash inflows that an investment or project will yield.

analysis is sensitive to the reliability of future cash inflows that an investment or project will yield. , first parameter is the discount rate for one period.

, first parameter is the discount rate for one period. and

and  .

. .

. ,where

,where  is the number of cash flows in the list of values.

is the number of cash flows in the list of values.