Difference between revisions of "Manuals/calci/TBILLYIELD"

Jump to navigation

Jump to search

| Line 51: | Line 51: | ||

==Related Videos== | ==Related Videos== | ||

| − | {{#ev:youtube| | + | {{#ev:youtube|v=0CCcKeuXy60|280|center|TBILLYIELD}} |

== See Also == | == See Also == | ||

Latest revision as of 15:13, 16 November 2018

TBILLYIELD (Settlement,Maturity,Price)

where,

- is the Treasury Bill's settlement date (a date when the Treasury Bill is purchased)

- is the Treasury Bill's maturity date (a date when the Treasury Bill expires)

- is the Treasury Bill's price per $100 face value.

- TBILLYIELD() returns the yield for a Treasury bill.

Description

TBILLYIELD (Settlement,Maturity,Price)

- and should be entered either in 'date format' or 'dates returned using formulas'. If dates are not valid, Calci displays #N/A error message.

- If >= , Calci displays #N/A error message.

- should not be more than one year than that of . Else, Calci displays #N/A error message.

- If <=0, Calci displays #N/A error message.

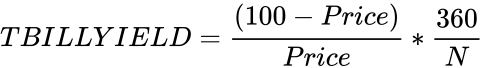

- Formula:

If 'N' is number of days from 'Settlement' to 'Maturity', then TBILLYIELD is calculated as -

Examples

Consider the following example that shows the use of TBILLYIELD function:

| 06/25/2014 | ||

| 10/25/2014 | ||

| 97.5 | ||

=TBILLYIELD(A1,A2,A3) : Calculates the yield for treasury bill with the input values from the cells A1 to A3.

Returns 0.07566204287515763 as a result. =TBILLYIELD(DATE(2013,10,20),DATE(2014,6,20),93.9) : Calculates the yield for treasury bill

with the values mentioned as arguments. Returns 0.09624107600678411 as a result.

Related Videos

See Also

References

is the Treasury Bill's settlement date (a date when the Treasury Bill is purchased)

is the Treasury Bill's settlement date (a date when the Treasury Bill is purchased) is the Treasury Bill's maturity date (a date when the Treasury Bill expires)

is the Treasury Bill's maturity date (a date when the Treasury Bill expires) is the Treasury Bill's price per $100 face value.

is the Treasury Bill's price per $100 face value.

. Else, Calci displays #N/A error message.

. Else, Calci displays #N/A error message.