Difference between revisions of "Manuals/calci/TBILLEQ"

Jump to navigation

Jump to search

(Created page with "<div id="6SpaceContent" class="zcontent" align="left"> '''TBILLEQ'''(SettlementDate, MaturityDate, Discount) where, '''SettlementDate '''- represents the Treasury b...") |

|||

| (9 intermediate revisions by 3 users not shown) | |||

| Line 1: | Line 1: | ||

| − | <div | + | <div style="font-size:30px">'''TBILLEQ (Settlement,Maturity,Discount)'''</div><br/> |

| + | where, | ||

| + | *<math>Settlement</math> is the Treasury Bill's settlement date (a date when the Treasury Bill is purchased) | ||

| + | *<math>Maturity</math> is the Treasury Bill's maturity date (a date when the Treasury Bill expires) | ||

| + | *<math>Discount</math> is the Treasury Bill's discount rate. | ||

| + | **TBILLEQ(), returns the bond-equivalent yield for a Treasury bill. | ||

| − | + | == Description == | |

| + | TBILLEQ (Settlement,Maturity,Discount) | ||

| − | + | *<math>Settlement</math> and <math>Maturity</math> should be entered either in 'date format' or 'dates returned using formulas'. If dates are not valid, Calci displays #N/A error message. | |

| + | *If <math>Settlement</math> >= <math>Maturity</math>, Calci displays #N/A error message. | ||

| + | *<math>Maturity</math> should not be greater than one year from <math>Settlement</math>. Else, Calci displays #N/A error message. | ||

| + | *If <math>Discount</math> <=0, Calci displays #N/A error message. | ||

| + | *Formula: | ||

| + | If 'N' is number of days from 'Settlement' to 'Maturity', then TBILLEQ is calculated as - | ||

| − | + | <math>TBILLEQ = \frac{(365 * Discount)}{(360 - (Discount * N))}</math> | |

| − | + | == Examples == | |

| − | + | Consider the following example that shows the use of TBILLEQ function: | |

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

<div id="2SpaceContent" class="zcontent" align="left"> | <div id="2SpaceContent" class="zcontent" align="left"> | ||

{| id="TABLE3" class="SpreadSheet blue" | {| id="TABLE3" class="SpreadSheet blue" | ||

|- class="even" | |- class="even" | ||

| − | + | | class="sshl_f" | 01/01/2010 | |

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | | class="sshl_f" | | ||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| class=" " | | | class=" " | | ||

| class=" " | | | class=" " | | ||

| + | |||

|- class="odd" | |- class="odd" | ||

| − | + | | class="sshl_f" | 11/20/2010 | |

| − | | class="sshl_f | ||

| − | |||

| class=" " | | | class=" " | | ||

| class=" " | | | class=" " | | ||

| + | |||

|- class="even" | |- class="even" | ||

| − | + | | class="sshl_f" | 5.85% | |

| − | | class="sshl_f | ||

| − | |||

| class=" " | | | class=" " | | ||

| class=" " | | | class=" " | | ||

| + | |||

|- class="odd" | |- class="odd" | ||

| − | | class=" | + | | class="sshl_f" | |

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| class=" " | | | class=" " | | ||

| class=" " | | | class=" " | | ||

|} | |} | ||

| − | < | + | =TBILLEQ(A1,A2,A3) : Calculates the bond equivalent yield for the Treasury Bill for values in the range A1 to A3. <br />Displays '''6.26%''' as a result. |

| − | + | =TBILLEQ(DATE(2013,10,20),DATE(2014,6,20),9%) : Calculates the bond equivalent yield for the Treasury Bill <br />for mentioned values. Displays '''9.72%''' as a result. | |

| + | |||

| + | ==Related Videos== | ||

| + | |||

| + | {{#ev:youtube|v=QLC8bGbOSfM|280|center|TBILLEQ}} | ||

| + | |||

| + | == See Also == | ||

| + | |||

| + | *[[Manuals/calci/TBILLPRICE | TBILLPRICE]] | ||

| + | *[[Manuals/calci/TBILLYIELD | TBILLYIELD]] | ||

| + | |||

| + | == References == | ||

| + | |||

| + | *[http://en.wikipedia.org/wiki/Treasury_bill#Treasury_bill Treasury Bill] | ||

| + | |||

| + | |||

| + | |||

| + | *[[Z_API_Functions | List of Main Z Functions]] | ||

| + | |||

| + | *[[ Z3 | Z3 home ]] | ||

Latest revision as of 13:33, 19 November 2018

TBILLEQ (Settlement,Maturity,Discount)

where,

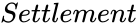

- is the Treasury Bill's settlement date (a date when the Treasury Bill is purchased)

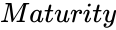

- is the Treasury Bill's maturity date (a date when the Treasury Bill expires)

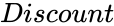

- is the Treasury Bill's discount rate.

- TBILLEQ(), returns the bond-equivalent yield for a Treasury bill.

Description

TBILLEQ (Settlement,Maturity,Discount)

- and should be entered either in 'date format' or 'dates returned using formulas'. If dates are not valid, Calci displays #N/A error message.

- If >= , Calci displays #N/A error message.

- should not be greater than one year from . Else, Calci displays #N/A error message.

- If <=0, Calci displays #N/A error message.

- Formula:

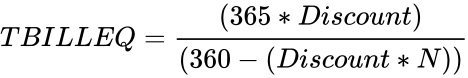

If 'N' is number of days from 'Settlement' to 'Maturity', then TBILLEQ is calculated as -

Examples

Consider the following example that shows the use of TBILLEQ function:

| 01/01/2010 | ||

| 11/20/2010 | ||

| 5.85% | ||

=TBILLEQ(A1,A2,A3) : Calculates the bond equivalent yield for the Treasury Bill for values in the range A1 to A3.

Displays 6.26% as a result. =TBILLEQ(DATE(2013,10,20),DATE(2014,6,20),9%) : Calculates the bond equivalent yield for the Treasury Bill

for mentioned values. Displays 9.72% as a result.

Related Videos

See Also

References

is the Treasury Bill's settlement date (a date when the Treasury Bill is purchased)

is the Treasury Bill's settlement date (a date when the Treasury Bill is purchased) is the Treasury Bill's maturity date (a date when the Treasury Bill expires)

is the Treasury Bill's maturity date (a date when the Treasury Bill expires) is the Treasury Bill's discount rate.

is the Treasury Bill's discount rate.