Difference between revisions of "Manuals/calci/FVIF"

Jump to navigation

Jump to search

(Created page with "<div style="font-size:30px">'''FVIF (PVIF)'''</div><br/> *<math>PVIF </math> is the present value interest factor. ==Description== *This function shows the Future value fact...") |

|||

| (4 intermediate revisions by the same user not shown) | |||

| Line 1: | Line 1: | ||

<div style="font-size:30px">'''FVIF (PVIF)'''</div><br/> | <div style="font-size:30px">'''FVIF (PVIF)'''</div><br/> | ||

| + | where | ||

*<math>PVIF </math> is the present value interest factor. | *<math>PVIF </math> is the present value interest factor. | ||

| + | **FVIF() shows the Future value factor. | ||

==Description== | ==Description== | ||

| − | + | ||

| − | + | FVIF(PVIF) | |

| + | *<math>PVIF</math> is the present value interest factor. | ||

*It is also called Future value interest factor. | *It is also called Future value interest factor. | ||

*The formula for the future value factor is used to calculate the future value of an amount per dollar of its present value. | *The formula for the future value factor is used to calculate the future value of an amount per dollar of its present value. | ||

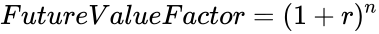

*The formula for Future value factor formula is: | *The formula for Future value factor formula is: | ||

| − | <math>Future Value Factor = (1 + r)^n</math> | + | <math>Future Value Factor = (1 + r)^n</math> |

| + | where <math>r</math> is the interest rate per period, and <math>n</math> the number of periods. | ||

| Line 15: | Line 19: | ||

#FVIF(1.084) = 0.9225092250922509 | #FVIF(1.084) = 0.9225092250922509 | ||

#FVIF(887187064230.8887) = 1.127158003444189e-12 | #FVIF(887187064230.8887) = 1.127158003444189e-12 | ||

| + | |||

| + | ==Related Videos== | ||

| + | |||

| + | {{#ev:youtube|v=B-qzELiAB24|280|center|Future value Interest}} | ||

==See Also== | ==See Also== | ||

Latest revision as of 15:18, 22 February 2019

FVIF (PVIF)

where

- is the present value interest factor.

- FVIF() shows the Future value factor.

Description

FVIF(PVIF)

- is the present value interest factor.

- It is also called Future value interest factor.

- The formula for the future value factor is used to calculate the future value of an amount per dollar of its present value.

- The formula for Future value factor formula is:

where is the interest rate per period, and the number of periods.

Examples

- FVIF(1000) = 0.001

- FVIF(1.084) = 0.9225092250922509

- FVIF(887187064230.8887) = 1.127158003444189e-12

is the present value interest factor.

is the present value interest factor.

where

where  is the interest rate per period, and

is the interest rate per period, and  the number of periods.

the number of periods.