Difference between revisions of "Manuals/calci/INTRATE"

Jump to navigation

Jump to search

| Line 39: | Line 39: | ||

maturity', then INTRATE is calculated as - | maturity', then INTRATE is calculated as - | ||

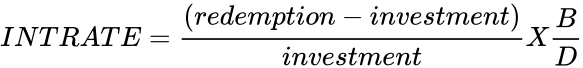

| − | <math>INTRATE = \frac{(redemption-investment)}{investment} X \frac{B}{ | + | <math>INTRATE = \frac{(redemption-investment)}{investment} X \frac{B}{D}</math> |

== Examples == | == Examples == | ||

Revision as of 07:56, 4 January 2014

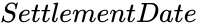

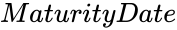

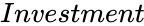

INTRATE(SettlementDate, MaturityDate, Investment, Redemption, Basis)

- where, is the security's settlement date (a date when coupon or a bond is purchased)

- is the security's maturity date (a date when coupon or a bond expires)

- is the amount invested in the security or a bond

- is the amount to be received at maturity of a bond

- is the type of day count basis to use

INTRATE() calculates the interest rate for a fully invested security.

Description

INTRATE(SettlementDate, MaturityDate, Investment, Redemption, Basis)

- and should be entered either in 'date format' or 'dates returned using formulas'. If dates are not valid, Calci displays #N/A error message.

- If >= , Calci displays #N/A error message.

- If <=0 or <=0, Calci displays #N/A error message.

- value is optional. If omitted, Calci assumes it to be 0.

Below table shows the use of values:

| Basis | Description |

|---|---|

| 0 | US (NASD) 30/360 |

| 1 | Actual/actual |

| 2 | Actual/360 |

| 3 | Actual/365 |

| 4 | European 30/365 |

- If value is other than 0 to 4, Calci displays #N/A error message.

- Formula:

If 'B' is number of days in a year, and 'D' is number of days from 'settlement' to maturity', then INTRATE is calculated as -

Examples

Consider the following example that shows the use of INTRATE function:

| 11/1/2010 | ||

| 2/20/2011 | 2/2/2014 | |

| 500000 | 7000 | |

| 800000 | 9000 | |

| 4 | 1 | |

=INTRATE(A1,A2,A3,A4,A5) displays 1.981651376146789 as a result. =INTRATE(DATE(2013,1,1),B2,B3,B4,B5) displays 0.2622154311211943 as a result.

is the security's settlement date (a date when coupon or a bond is purchased)

is the security's settlement date (a date when coupon or a bond is purchased) is the security's maturity date (a date when coupon or a bond expires)

is the security's maturity date (a date when coupon or a bond expires) is the amount invested in the security or a bond

is the amount invested in the security or a bond is the amount to be received at maturity of a bond

is the amount to be received at maturity of a bond is the type of day count basis to use

is the type of day count basis to use