Difference between revisions of "Manuals/calci/ISPMT"

Jump to navigation

Jump to search

(Created page with "<div id="6SpaceContent" class="zcontent" align="left"> <font color="#000000"><font face="Arial, sans-serif"><font size="2">'''ISPMT(R, per, nper, PV)'''</font></font></font> ...") |

|||

| (8 intermediate revisions by 3 users not shown) | |||

| Line 1: | Line 1: | ||

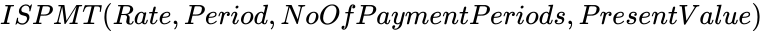

| − | <div | + | <div style="font-size:30px">'''ISPMT (Rate,Period,NoOfPaymentPeriods,PresentValue)'''</div><br/> |

| − | < | + | *<math>Rate</math> is the interest rate. |

| + | *<math>Period</math> is the period. | ||

| + | *<math>NoOfPaymentPeriods</math> is the total number of payment periods. | ||

| + | *<math>PresentValue</math> is the at present value. | ||

| + | **ISPMT(), calculates the interest paid during a specific period of an investment | ||

| − | </ | + | ==Description== |

| − | - | + | *This function calculates the interest paid, during a specific period of a loan or investment. |

| − | + | *In <math>ISPMT (Rate,Period,NoOfPaymentPeriods,PresentValue)</math>, <math>Rate</math> is the rate of interest for the period.Suppose we are taking a loan for 8 percent annual interest rate and paying the amount in monthly, then the <math>Rate</math> value is 8%/12. | |

| + | *So we have to enter the <math>Rate</math> value as 8%/12 or 0.6667% or 0.006667 in to the formula as the rate. | ||

| + | *<math>Period</math> indicates the period and it is lying with in 1 to nper. | ||

| + | *<math>NoOfPaymentPeriods</math> is the total number of payment periods in an annuity. | ||

| + | *<math>PresentValue</math> is the present value-the total amount that a series of future payments is worth now. | ||

| + | *The arguments rate and the nper are expressed in the correct units. | ||

| + | months = 12 * years; monthly rate = annual rate / 12 | ||

| + | quarters = 4 * years; quarterly rate = annual rate / 4 . | ||

| + | *The returned values are negative which is representing the cash we pay out like deposits to savings or other withdrawals. | ||

| + | *Also the returned values are positive which is representing the cash we receive like dividend checks and other deposits. | ||

| + | *This function give result as error when | ||

| + | Any one of the arguments are not recognised as numeric values. | ||

| − | + | ==Examples== | |

| + | #=ISPMT(9.75%/12,1,5*12,500000) = -3994.791667 | ||

| + | #=ISPMT(9%,2,4,350000) = -15750 | ||

| + | #=ISPMT(9%/12,3,4*12,350000) = -2460.9375 | ||

| − | + | ==Related Videos== | |

| − | |||

| − | |||

| − | + | {{#ev:youtube|v=RN3DA2eVM2c|280|center|ISPMT}} | |

| − | |||

| − | + | ==See Also== | |

| − | + | *[[Manuals/calci/FV | FV ]] | |

| − | + | *[[Manuals/calci/IPMT | IPMT ]] | |

| + | *[[Manuals/calci/PPMT | PPMT ]] | ||

| − | ISPMT | + | ==References== |

| + | *[https://wiki.openoffice.org/wiki/Documentation/How_Tos/Calc:_ISPMT_function ISPMT] | ||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | + | *[[Z_API_Functions | List of Main Z Functions]] | |

| − | |||

| − | |||

| − | + | *[[ Z3 | Z3 home ]] | |

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

Latest revision as of 15:58, 15 November 2018

ISPMT (Rate,Period,NoOfPaymentPeriods,PresentValue)

- is the interest rate.

- is the period.

- is the total number of payment periods.

- is the at present value.

- ISPMT(), calculates the interest paid during a specific period of an investment

Description

- This function calculates the interest paid, during a specific period of a loan or investment.

- In , is the rate of interest for the period.Suppose we are taking a loan for 8 percent annual interest rate and paying the amount in monthly, then the value is 8%/12.

- So we have to enter the value as 8%/12 or 0.6667% or 0.006667 in to the formula as the rate.

- indicates the period and it is lying with in 1 to nper.

- is the total number of payment periods in an annuity.

- is the present value-the total amount that a series of future payments is worth now.

- The arguments rate and the nper are expressed in the correct units.

months = 12 * years; monthly rate = annual rate / 12 quarters = 4 * years; quarterly rate = annual rate / 4 .

- The returned values are negative which is representing the cash we pay out like deposits to savings or other withdrawals.

- Also the returned values are positive which is representing the cash we receive like dividend checks and other deposits.

- This function give result as error when

Any one of the arguments are not recognised as numeric values.

Examples

- =ISPMT(9.75%/12,1,5*12,500000) = -3994.791667

- =ISPMT(9%,2,4,350000) = -15750

- =ISPMT(9%/12,3,4*12,350000) = -2460.9375

Related Videos

See Also

References

is the interest rate.

is the interest rate. is the period.

is the period. is the total number of payment periods.

is the total number of payment periods. is the at present value.

is the at present value.

,

,