Difference between revisions of "Manuals/calci/PV"

Jump to navigation

Jump to search

| (2 intermediate revisions by 2 users not shown) | |||

| Line 1: | Line 1: | ||

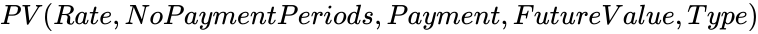

| − | <div style="font-size:30px">'''PV( | + | <div style="font-size:30px">'''PV (Rate,NoPaymentPeriods,Payment,FutureValue,Type)'''</div><br/> |

| − | *<math> | + | |

| − | *<math> | + | *<math>Rate</math> is the interest rate. |

| − | *<math> | + | *<math>NoPaymentPeriods</math> is the total number of payment periods. |

| − | *<math> | + | *<math>Payment</math> is the amount of the payment made each period. |

| − | *<math> | + | *<math>FutureValue</math> is the future value. |

| + | *<math>Type</math> is the type. | ||

| + | **PV(), returns the present value of an investment. | ||

==Description== | ==Description== | ||

| Line 10: | Line 12: | ||

*It is based on an interest rate and a constant payment schedule. | *It is based on an interest rate and a constant payment schedule. | ||

*This function calculates the present value of an investment, which is the total amount that a series of future payments is worth presently. | *This function calculates the present value of an investment, which is the total amount that a series of future payments is worth presently. | ||

| − | *In <math>PV( | + | *In <math>PV (Rate,NoPaymentPeriods,Payment,FutureValue,Type)</math>,<math>Rate</math> is the rate of interest for the period. |

| − | *Suppose we are taking a loan for 8 percent annual interest rate and paying the amount in monthly, then the <math> | + | *Suppose we are taking a loan for 8 percent annual interest rate and paying the amount in monthly, then the <math>Rate</math> value is 8%/12. |

| − | *So we have to enter the <math> | + | *So we have to enter the <math>Rate</math> value as 8%/12 or 0.6667% or 0.006667 in to the formula as the rate. |

| − | *<math> | + | *<math>NoPaymentPeriods</math> is the total number of payment periods in an annuity. |

| − | *<math> | + | *<math>Payment</math> is the payment made each period in the annuity. |

*Normally, the payment is set over the life of the annuity and includes principal plus interest without any other fees. | *Normally, the payment is set over the life of the annuity and includes principal plus interest without any other fees. | ||

| − | *<math> | + | *<math>FutureValue</math> is the future value of an investment or loan (the value you want to achieve at the end of all periods) when we are omitting the value of <math>FutureValue</math> ,then it is assumed to be 0. |

| − | *<math> | + | *<math>Type</math> is the number 0 or 1 which is specifies the time to make a payment during the period. |

| − | *when we are not giving the value of <math> | + | *when we are not giving the value of <math>Type</math>, then it is assumed to be 0. |

{| class="wikitable" | {| class="wikitable" | ||

|- | |- | ||

| − | ! | + | ! Type value |

! Explanation | ! Explanation | ||

|- | |- | ||

| Line 55: | Line 57: | ||

==References== | ==References== | ||

*[https://wiki.openoffice.org/wiki/Documentation/How_Tos/Calc:_PV_function Pv] | *[https://wiki.openoffice.org/wiki/Documentation/How_Tos/Calc:_PV_function Pv] | ||

| + | |||

| + | |||

| + | |||

| + | *[[Z_API_Functions | List of Main Z Functions]] | ||

| + | |||

| + | *[[ Z3 | Z3 home ]] | ||

Latest revision as of 16:13, 27 July 2018

PV (Rate,NoPaymentPeriods,Payment,FutureValue,Type)

- is the interest rate.

- is the total number of payment periods.

- is the amount of the payment made each period.

- is the future value.

- is the type.

- PV(), returns the present value of an investment.

Description

- This function gives the present value for an investment.

- It is based on an interest rate and a constant payment schedule.

- This function calculates the present value of an investment, which is the total amount that a series of future payments is worth presently.

- In , is the rate of interest for the period.

- Suppose we are taking a loan for 8 percent annual interest rate and paying the amount in monthly, then the value is 8%/12.

- So we have to enter the value as 8%/12 or 0.6667% or 0.006667 in to the formula as the rate.

- is the total number of payment periods in an annuity.

- is the payment made each period in the annuity.

- Normally, the payment is set over the life of the annuity and includes principal plus interest without any other fees.

- is the future value of an investment or loan (the value you want to achieve at the end of all periods) when we are omitting the value of ,then it is assumed to be 0.

- is the number 0 or 1 which is specifies the time to make a payment during the period.

- when we are not giving the value of , then it is assumed to be 0.

| Type value | Explanation |

|---|---|

| 0 | Payments are due at the end of the period |

| 1 | Payments are due at the beginning of the period |

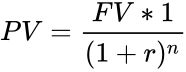

- The present value can be calculated using the following formula:

- where is the future value, is the rate of interest, is the number of periods.

- Also the result is coming in a negative sign ,it is indicating the money that we would pay, an outgoing cash flow.

- The interest rate is dividing by 12 to get a monthly rate.

- The years the money is paid out is multiplied by 12 to get the number of payments.

Examples

- =PV(9.2%/12,15*12,10000,0) =-974470.2640587

- =PV(5%/12,25*12,25000,0) = -4276501.176022

- =PV(5%/12,25*12,25000,1) = -4276501.46327

Related Videos

See Also

References

is the interest rate.

is the interest rate. is the total number of payment periods.

is the total number of payment periods. is the amount of the payment made each period.

is the amount of the payment made each period. is the future value.

is the future value. is the type.

is the type.

,

,

is the future value,

is the future value,  is the rate of interest,

is the rate of interest,  is the number of periods.

is the number of periods.