Difference between revisions of "Manuals/calci/VDB"

Jump to navigation

Jump to search

| Line 1: | Line 1: | ||

| − | <div style="font-size:30px">'''VDB( | + | <div style="font-size:30px">'''VDB (Cost,Salvage,Life,StartPeriod,EndPeriod,Factor,SwitchFlag)'''</div><br/> |

| − | *<math> | + | *<math>Cost</math> is the initial cost of the asset |

*<math>Salvage</math> is the value at the end of the depreciation | *<math>Salvage</math> is the value at the end of the depreciation | ||

| − | *<math> | + | *<math>Life</math> is the number of periods over which the asset is depreciated |

| − | *<math> | + | *<math>StartPeriod</math> is the Ending periods to calculate the depreciation |

| − | *<math> | + | *<math>EndPeriod</math> is the Starting periods to calculate the depreciation |

*<math>Factor</math> is the rate at which the balance declines | *<math>Factor</math> is the rate at which the balance declines | ||

| − | *<math> | + | *<math>SwitchFlag</math> is a logical value specifying whether to switch to straight-line depreciation when depreciation is greater than the declining balance calculation. |

==Description== | ==Description== | ||

Revision as of 17:57, 30 July 2018

VDB (Cost,Salvage,Life,StartPeriod,EndPeriod,Factor,SwitchFlag)

- is the initial cost of the asset

- is the value at the end of the depreciation

- is the number of periods over which the asset is depreciated

- is the Ending periods to calculate the depreciation

- is the Starting periods to calculate the depreciation

- is the rate at which the balance declines

- is a logical value specifying whether to switch to straight-line depreciation when depreciation is greater than the declining balance calculation.

Description

- This function computes the depreciation of an asset for any period you specify, using the double-declining balance method.

- To calculate depreciation, VDB uses a fixed rate.

- When factor = 2 this is the double-declining-balance method (because it is double the straight-line rate that would depreciate the asset to zero).

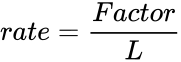

- The rate is given by:

Example

| A | B | |

|---|---|---|

| 1 | Initial Cost(C) | 3500 |

| 2 | Salvage | 350 |

| 3 | Number of Periods | 12 |

| 4 | Starting Period(SP) | 0 |

| 5 | Ending Period(EP) | 2 |

1. =VDB(B1,B2,B3*12,B4,B5)

96.54706790123419

2. =VDB(10000,500,10,0,2)

3599.9999

Related Videos

See Also

References

is the initial cost of the asset

is the initial cost of the asset is the value at the end of the depreciation

is the value at the end of the depreciation is the number of periods over which the asset is depreciated

is the number of periods over which the asset is depreciated is the Ending periods to calculate the depreciation

is the Ending periods to calculate the depreciation is the Starting periods to calculate the depreciation

is the Starting periods to calculate the depreciation is the rate at which the balance declines

is the rate at which the balance declines is a logical value specifying whether to switch to straight-line depreciation when depreciation is greater than the declining balance calculation.

is a logical value specifying whether to switch to straight-line depreciation when depreciation is greater than the declining balance calculation.